With the rapid growth of the digital finance industry come not only new opportunities, but also, new risks and cleverly orchestrated scams designed to trick people with false promises or into participating in illicit financial activities. One of the scams that everyone should watch out for are money mule scams.

Money mule scams are a type of money laundering activity that criminals use to get away with their illegally obtained funds. The primary objective of money mule scams is to manipulate other people to transfer money for criminals to make it appear that the transactions are legitimate or legal.

What is a money mule?

A money mule can be any person who, willingly, or unwittingly, is coerced into becoming a middleman for criminals to transfer or receive funds for them. These funds are often used in illicit activities such as fraud, hacking, malware and phishing scams, gambling or drug trafficking operations, and even terrorism. Funds transferred through money mules make the jobs of law enforcement agencies much harder when it comes to tracking and investigating criminal activities.

How do money mules scams operate?

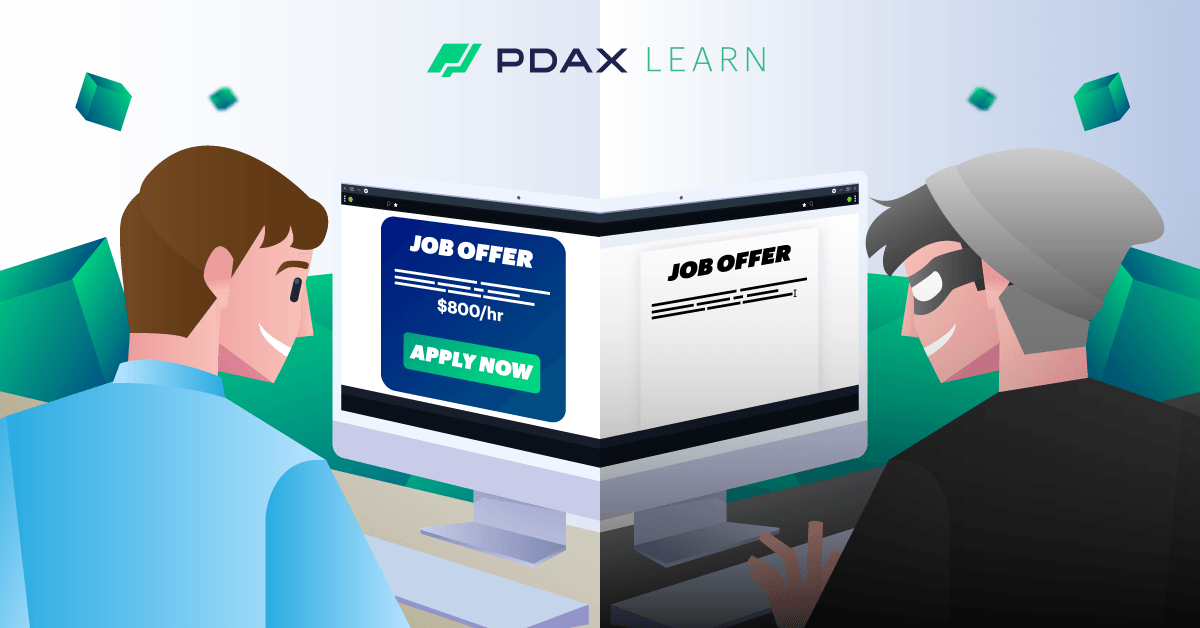

A money mule is often recruited with promises of easy profits in the guise of a legitimate job opportunity, or as a favor for a “romantic interest” that one happens to meet online. Money mules may be completely unaware that they are participating in an illegal activity, may have limited knowledge about laws or financial transactions, or may be fully aware of the scam but have been convinced with false promises to go along with the scheme and take a risk.

Money mules scams can take many forms but there will always be red flags that can tell you when you have to be skeptical.

Money mule schemes ask you to use your own account

Because the operations behind money mule schemes are illegitimate, they will ask you to use your own personal account, or open up a new account for them to send and receive money. These can involve bank or wire transfers, cashier’s checks, debit or credit card purchases, or courier and remittance services.

More popularly nowadays, cryptocurrency platforms are also being used for money mule operations because of the speed and ease of transfers. Cryptocurrency users are often asked to use their own wallets or their own accounts on exchanges to move money for their “employer”in order to bypass a platform’s security and know-your-customer (KYC) policies.

Money mules schemes often have vague job descriptions

Money mule schemes often use vague job labels such as ‘payment processor’ or ‘fund agent’ or ‘freelance money processor’ and many similar sounding titles that do not give a clear idea about what the role requires. Often, the amount of compensation given to the money mule is also unclear or inconsistent.

Money mule schemes often target a specific demographic

Anyone can fall victim to a money mule scheme, but the people behind these illicit operations often target a specific demographic that may be more prone to falling for their tactics. These include people who are not financially literate and are more easily lured by promises of huge paybacks, or single or elderly people on dating sites who may be emotionally susceptible to carry out favors for someone they have developed a relationship with online.

How do I avoid falling for money mule scams?

There are many simple measures that one can take to limit the likelihood of becoming a money mule, and avoid the potential consequences that can result from one’s involvement.

- Educate yourself - Knowledge is always the first line of defense against any type of financial scam. Before engaging in any financial transaction, it is important that you have done your research with regard to the nature of the transaction, the asset, and the parties involved,; that you are aware of any ethical or legal concerns,; and that you are updated with the latest news.

- Be skeptical - Always be skeptical when an opportunity sounds too good to be true. Do not fall for get-rich-quick offers and be wary of developing personal and intimate bonds with strangers that you just met online. Often the people behind money mule schemes like to make up emotionally charged stories or claim they are in an emergency and are unable to use their own accounts to send money to their “relatives” for instance.

- Secure your accounts - Never give away any details about your personal bank accounts such as account numbers, email addresses, or passwords. Any legitimate business will have no need for such information from you.

- Report suspicious activities - If you have encountered or fallen victim to money mule scams, make it a point to report any incidents to law enforcement agencies to curb the spread of cybercriminal activities and prevent other people and loved ones from falling for their schemes.

Legal consequences

Lastly, even if the offers can be tempting, it is important to be reminded of the potential consequences for being involved in money mule scams. In the Philippines, violators can be prosecuted under Republic Act No. 9160 or the Anti-Money Laundering Act. The penalty for such actions can lead to imprisonment and significant fines.

Other countries, likewise, have their own corresponding laws which may deal harsher penalties should you happen to be under their jurisdiction.

Got an incident to report? Contact us at https://support.pdax.ph/ or email support@pdax.ph to help keep our platforms safe and secure.

Ready to start with crypto?

Start your trading journey with PDAX.

DISCLAIMER: The statements in this article do not constitute financial advice. PDAX does not guarantee the technical and financial integrity of the digital asset and its ecosystem. Any and all trading involving the digital asset is subject to the user’s risk and discretion and must be done after adequate and in-depth research and analysis.

For inquiries or complaints, please contact us through https://support.pdax.ph or email us at support@pdax.ph. Please provide us your name, email address, and any other information that we may need to identify you, your PDAX account, and the particulars of the order or transaction on which you have feedback, questions, or complaints.

The Philippine Digital Asset Exchange Inc (PDAX) is an entity regulated by the Bangko Sentral ng Pilipinas (BSP) https://www.bsp.gov.ph. You may get in touch with the BSP Consumer Protection and Market Conduct Office through consumeraffairs@bsp.gov.ph or through the following numbers: (02) 5306 2584 / (02) 8708 7087; Trunk Line: (02) 8708 7701 loc. 2584; or SMS: 21582277 (for Globe subscribers only). For further details, you may refer to BSP's Inclusive Finance - Consumer Protection.

About PDAX

PDAX is a BSP-licensed exchange where you can trade Bitcoin, Ethereum, and other cryptocurrencies directly using PHP!

Featured Posts

You might also like

Bitcoin rallies, DOGE jumps 15%, HYPE may retest

PDAX

March 06, 2026

PDAXScope: Circle posts USDC earnings, BTC ETFs draw $506M

PDAX

February 27, 2026

PDAXScope: Crypto market today: ETH eyes $2.5K, BTC at $69K

PDAX

February 20, 2026

USA₮ (USAT) is now on PDAX!

PDAX

February 19, 2026